An unsold item is a product which has not been the object of a definitive sale to a private customer or a discounter.

The company is obliged to dispose of such products in order to make room for new collections. These products consequently enter the company’s “waste” category, in keeping with the legal definition of waste: any substance or object which the holder disposes of, intends to dispose of or is obliged to dispose of (Article L.541-1-1 of the French Environment Code).

The future of waste

The European Framework Directive 2008/98/CE prioritises waste processing methods. Article L. 541-1-1 of the French Environment Code describes this prioritisation:

Namely, reuse is defined as any operation by which substances, materials or products which are not waste are once again used for a purpose which is identical to that for which they were designed. Reuse falls within the scope of prevention as it consists in delaying the moment when a product becomes waste by extending the time it is placed on the market.

Application to CHF

Donations or sales of products which can still be worn to charitable associations and / or to approved Solidarity-Based Enterprises of Social Utility or to personnel.

NB : the donation and sale of non-defective products, including to personnel, consist in product reuse operations, enabling products to avoid becoming waste. The product is clearly placed on the market, it is therefore subject to the Eco TLC fee.

Preparation with a view to reuse is defined as any operation by which substances, materials or products which have become waste are used once again. In practice, this concerns products which are the focus of sorting and preparation by waste management operators on the basis of the volumes of domestic waste which are separately collected (specific containers in the public or private domain, namely waste landfills). It can also consist in defective products which have been abandoned or entrusted to waste management operators by companies. Whichever the case, it clearly consists in waste as the products cannot be placed on the market in their current state. Following the sorting and preparation operation, certain products are reused in keeping with their initial usage (second-hand goods market in France or for export); others are sent to be prepared for recycling.

Application to CHF: sorting carried out by operators accredited by Eco TLC on the basis of the volumes collected at self-deposit banks identified by Eco TLC (46 000 addresses in France : clothing banks, shops, local branch of an association, landfill https://refashion.fr/citoyen/fr/point-dapport - used product collection operations in shops, organized by the brands in partnership with operators, come within this category.

The ban on destroying unsold items was introduced by the French law against wastage and for the circular economy of February 10, 2020.

The law imposes that by January 1, 2022 at the latest, all marketers must comply with the hierarchy of processing methods for unsold, new, non-food products (Article L.441-15-8 of the French Environment Code). A producer, importer or supplier who (voluntarily or through negligence) diverts an unsold item from its possible reuse or failing this, its possible recycling, will be liable to a fine of up to €15 000 in the case of a legal entity.

The following practices will namely be sanctioned:

-

Damaging good condition CHF with a view to rendering it non-reusable

-

Disposing of unsold items in waste containers on the public highway, including defective items which can no longer be worn but which can be recycled.

-

Incinerating unsold items

By way of exception, products presenting a risk to health or safety (eg : exceeding REACH limits) or whose elimination is prescribed by law (eg : counterfeit), may continue to be destroyed.

Recourse by the brands to partnerships with charity associations and / or waste management operators permits products which are donated or sold in exchange for payment to be reused in keeping with the law. This also applies to product donations and sales to personnel given that it consists in a method of reuse.

The law entrusts the role of “Policeman of Unsold Items” to the DGCCRF (French General Directorate for Competition Policy, Consumer Affairs and Fraud Control)(extension of Article L. 511-7 of the French Consumer Code). It is therefore wise for companies to have proof establishing that their unsold items have been managed in keeping with Article L.541-10-8, in the event of inspections. It is also probable that producers, importers or suppliers will be questioned, in a general manner, by charity associations or consumers with respect to their unsold items management policy.

Practical case

A company has a stock of unsold CHF items and wants to dispose of it. This stock is composed of both defective items (customer returns, damaged items which cannot be sold) and items in good condition.

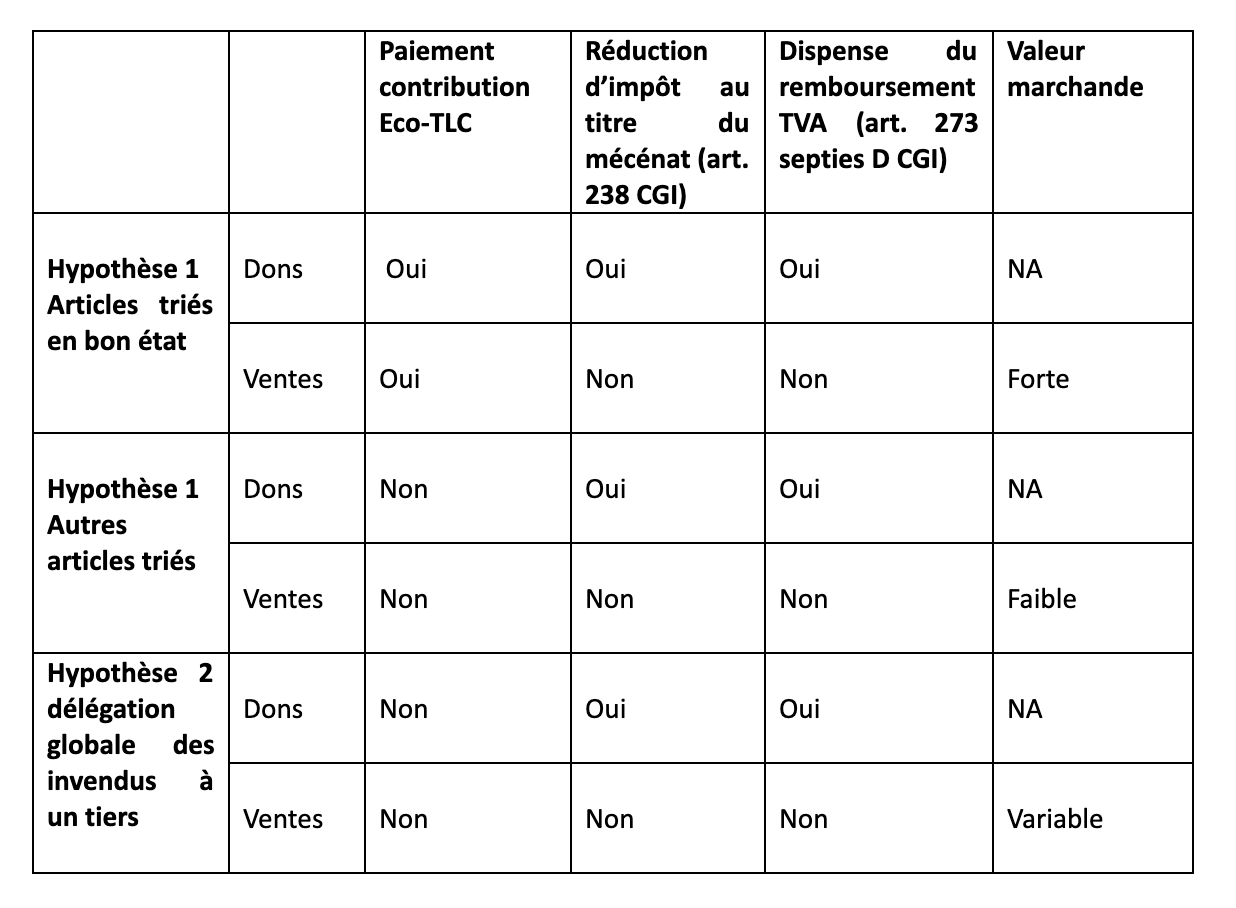

Hypothesis 1: the marketer carries out sorting

The company chooses to donate or sell the items in good condition. This consists in a case of reuse, subject to Eco TLC fees. If it consists in a donation to a general interest organisation, this constitutes corporate sponsorship which is tax deductible (Article 238 bis of the French General Tax Code).

The company sells the remaining items to a waste management operator which collects them, sorts them and recycles them. This price is negotiated with the potential buyer depending on the logistical costs to be met and the value of product and component reuse in terms of materials or energy. Any products not placed on the market become company waste: they are not subject to the Eco TLC fee.

Hypothesis 2: the marketer delegates the entire unsold item processing process to a third party

The company calls on a potential buyer (association or waste operator which frequently perform both activities) which deals with all of the items. The products are not considered as being placed on the market and are therefore not subject to Eco TLC fees. The potential buyer carries out collection, sorting and recovery of the items, in keeping with the processing methods hierarchy mentioned above. If the choice is made to donate products to a general interest organisation is made, this also constitutes corporate sponsorship, leading to tax deductions.

The company’s decision will depend on fiscal and economic parameters.

Fiscal parameters:

Taxation of donations to general interest organisations (Article 238 of the French General Tax Code): the donation gives rise to a tax deduction to the order of 60% of the sum of the donation, up to a total sum of €2 M and of 40% beyond this limit. However, it is possible to maintain the 60% rate of deduction beyond €2 M when the donation is made to the benefit of “non-profit making organisations which supply items to persons in difficulty free of charge”, for essential items such as “clothing, quilts and blankets”.

VAT system: French tax authorities consider that the remittance of VAT initially deducted when goods are purchased is not required in the event of the donation of these goods. This has been expressly established by the law on the circular economy in the French General Tax Code (Article 273 septies D of the French General Tax Code).

Economic parameters:

Payment or not of the eco-fee depending on whether it consists in the reuse or the management of company waste.

Value of the products :

— If the company has been able to value good quality items at a good price, namely by carrying out prior sorting, it can derive a certain profit from them. It can be more beneficial to sell these products than to benefit from the tax regime applying to donations.

— Conversely, items which are difficult to value (items which are greatly depreciated, of a low initial value, with a significant proportion of damaged products…) present a very low economic interest.

— The decision to delegate the entire treatment process to a third party reduces the value of items: the potential buyer covers all costs, namely sorting, and will include them in his purchase bid. Everything will therefore depend on the quality of the products.

The company will need to strike a balance with respect to these parameters depending on the circumstances, the type of products and its financial situation.

The decision to donate, which is beneficial from the point of view of taxation, is the most frequent choice made, but not the only one. The company’s capacity to promote unsold items is a key variable: it can sometimes be more advantageous to sell unsold items. With the development of the circular economy and new outlets, the demand for materials is increasing and companies must be aware that their unsold items can have their own economic value.